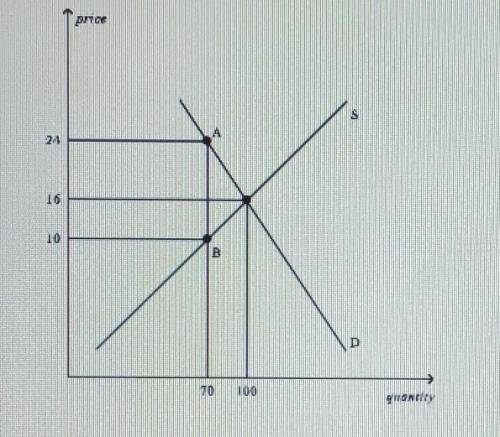

What is the equilibrium price in the market before the tax imposition? (5 points) As the figure is drawn, who sends the tax payment to the government? (10 points)

What is the price that buyers pay after the tax imposition? (5 points)

What is the effective price that sellers receive after the tax imposition? (5 points)

What is the amount of tax per unit? (5 points)

What is the burden of the tax on buyers? (5 points)

What is the burden of the tax on sellers? (5 points)

How much tax revenue does this tax generate for the government? (10 points)

Ответы

Показать ответы (3)

Другие вопросы по теме Математика

Популярные вопросы

- Сочинение 7 класс тема Мой будущий бизнес кратко и понятно...

1 - Қазіргі замандағы қожа эссе...

3 - Определи величины углов равнобедренного треугольника NEC, если внешний угол...

3 - Акай мергенди кандай элестетесиң? Сүрөтүн тарт...

3 - за спам подам жалобу РЕШИТЕ НЕРАВЕНСТВО И ЗАПИШИТЕ МНОЖЕСТВО ЦЕЛЫХ РЕШЕНИЙ|2х+3|...

2 - 1)5,3 м = ... см ; 3)34 м² = ... дм²; 5)6,315 т= ... ц; 7)12,7 дм; 9)0,06...

1 - Кымде кым жаксы корсе сол кушты негызы дайексоздерды жазу...

2 - Вариант 1 1) Выберите продолжение утверждения Газы принимаю форму сосуда...

1 - Выпишите только словосочетания с действительными причастиями, выделите суффиксы....

1 - ответь на вопросы 1) Каким был Филька 2) Как они...

1