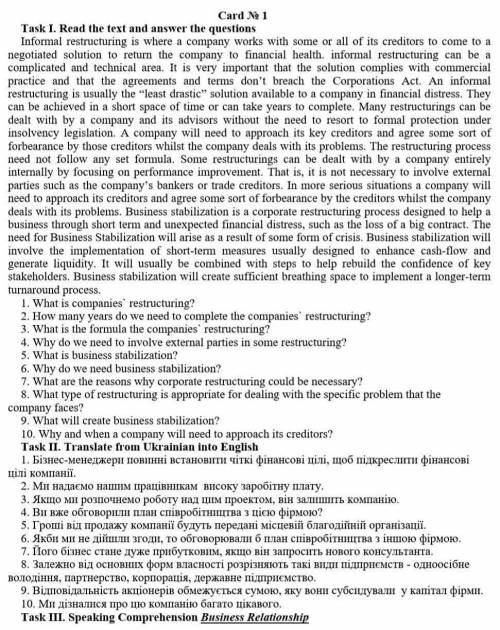

Informal restructuring is where a company works with some or all of its creditors to come to a negotiated solution to return the company to financial health. informal restructuring can be a

complicated and technical area. It is very important that the solution complies with commercial practice

and that the agreements and terms don’t breach the Corporations Act. An informal restructuring is

usually the “least drastic” solution available to a company in financial distress. They can be achieved

in a short space of time or can take years to complete. Many restructurings can be dealt with by a

company and its advisors without the need to resort to formal protection under insolvency legislation.

A company will need to approach its key creditors and agree some sort of forbearance by those creditors

whilst the company deals with its problems. The restructuring process need not follow any set formula.

Some restructurings can be dealt with by a company entirely internally by focusing on performance

improvement. That is, it is not necessary to involve external parties such as the company’s bankers or

trade creditors. In more serious situations a company will need to approach its creditors and agree some

sort of forbearance by the creditors whilst the company deals with its problems. Business stabilization

is a corporate restructuring process designed to help a business through short term and unexpected

financial distress, such as the loss of a big contract. The need for Business Stabilization will arise as a

result of some form of crisis. Business stabilization will involve the implementation of short-term

measures usually designed to enhance cash-flow and generate liquidity. It will usually be combined

with steps to help rebuild the confidence of key stakeholders. Business stabilization will create

sufficient breathing space to implement a longer-term turnaround process.

1. What is companies` restructuring?

2. How many years do we need to complete the companies` restructuring?

3. What is the formula the companies` restructuring?

4. Why do we need to involve external parties in some restructuring?

5. What is business stabilization?

6. Why do we need business stabilization?

7. What are the reasons why corporate restructuring could be necessary?

8. What type of restructuring is appropriate for dealing with the specific problem that the

company faces?

9. What will create business stabilization?

10. Why and when a company will need to approach its creditors?

сначала 1 вопрос

Ответы

Показать ответы (3)

Другие вопросы по теме Английский язык

Популярные вопросы

- Составить план ответа на вопрос : что такое добродетели ....

1 - Выберите меньшие из чисел 99/98 1,067 4/3 и решиние как вы нашли...

3 - Скласти письмову розповідь про те як ти єш мамі...

2 - Після закриття програми ms word: а) буфер обміну ms office вміщує...

1 - Выражение b/ a(в квадрате) - b(в квадрате) : b/ a(в квадрате) + ab...

1 - Придумать предложение зи словом бур янець...

3 - Что такое контраст ? запишите два примера использования контраста...

2 - Построение прямой, проходящей через точку, не лежащую на данной прямой...

1 - Сообщения о засухоустойчивых растениях...

2 - Решите *** а1. найдите предложение с причастным оборотом.а) шумел...

3